There can be little remaining argument that true customer centricity is massively deeper than any single attribute or characteristic of an organisation. Customer centricity has to be ‘balanced’ in its emphasis between providing great customer experiences and delivering the framework within which organisations can deliver fair and sustainable returns.

This article proposes what some of the key indicators and requirements of a customer centric organisation should be. So, if you know an organisation that is like the one described below then it is very likely that it can claim true customer centricity.

You will have defined YOUR required nature of customer centricity

Customer centricity is not one-size-fits-all. There are of course some ‘core’ elements but there is also a huge degree of configuration that organisations need to do to define exactly what they want it to look like and do for them. To really deliver against this clarity the leading organisations are recognising the need to have a number of levels of definition. The entry requirement is the almost inevitable, high level statement to emphasize that customers are as important (at least) as shareholders, employees and social responsibilities. This typically takes the form of making “Customer focus” one of the four or five key imperatives for the organisation. This does give customer centricity some stature but is not typically very useful in terms of steering activity and prompting the right behaviours.

The next, and often missing, level is the ‘rallying cry’ which is a succinct but meaningful statement that will give out clues to all of the relevant stakeholders about the nature of customer centricity for which the organisation is aiming. A great example we have seen recently is: “We will attract, fight to retain and prize the loyalty of customers who we can reasonably predict will be profitable and who will value our proposition to them”

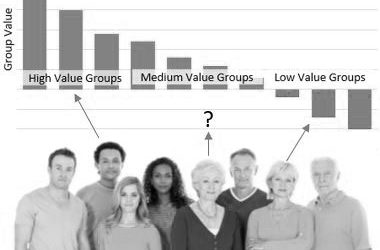

The final level is the full definition of customer centricity that represents the reference point for many of the organisation’s customer-impacting decisions. It will have been formally signed off by the senior leadership team to prevent constantly re-visiting principles that should be established once. It may be a short document in its own right and will be broken down into key dimensions along which the required type of customer centricity can be placed. For instance: What is the balance required between quantity and quality of customers? Is the organisation seeking universal customer delight or just a high enough level of satisfaction to prevent defection?

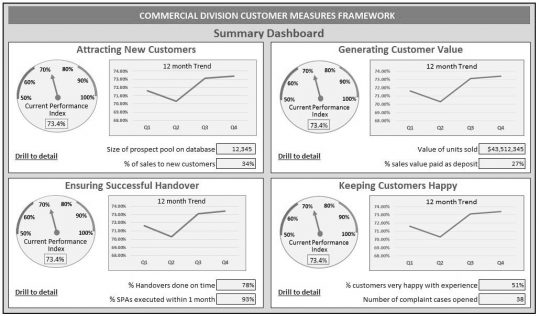

Customers will be THE basic unit of your planning and measurement

Your market and sales planning will start with customers as the basic unit rather than gallons, tonnes, policies, units etc. etc. It will recognise that sales are an attribute of customers and not the other way around – without customers there are no sales. So, volume / revenue increases come from attracting more customers, stopping existing customers from leaving and encouraging them to buy more. In customer centric organisations no-one puts forward a sales plan that just proposes a 10% uplift in volume without a clear rationale of where this will come from in terms of winning more / better customers, keeping more customers and developing their value.

Measures at all levels will be as focussed on customer dimensions as regions, outlets, products etc. The senior management team will know how many customers they have, how many are active, how many they are losing and how much they buy rather than just knowing “we sold 100,000 units”. Even at the micro-level measures will be phrased as (for instance) “Percentage of your customers who were really happy” rather than “CSI Score”.

There will be meaningful CUSTOMER STANDPOINT input to all customer-impacting decisions

Rather than the informal “Let’s think about this from the customer’s point of view” requests in decision-making meetings the organisation will have engineered input of the customer standpoint into all decision processes where the customer could be impacted, even indirectly. At the most operational level a network of customer advocates in all functions will be continuously briefed with the results of customer research, feedback and listening. All decision processes must include at least one of the members of this network and they are responsible for reporting back on decisions that they feel will not work for customers as well as inputting the customer dimension to the decision process.

At the more senior and strategic level a Customer Experience Director or Chief Customer Officer will have a meaningful impact on major decision-making and strategy setting. They will be a customer professional and not just a ‘nominated’ individual to enable the organisation to say that is has this role in place. Although they are as responsible for profitability as all other senior managers they will be the constant reminder that profit only comes from customers.

Structural barriers to great experiences will have been MITIGATED

It is simply not possible to design and build an organisation that is totally engineered for customer centricity. The utopia of organisational units that map directly onto different segments of customers and customer service that is located in the geographical heart of the customer base is not normally achievable. An organisation that is customer centric will have identified all those barriers to delivering great experiences. These will be in areas such as organisational structure, geographical location, outsourcing arrangements, parent company constraints and rules etc.

Customer-focussed mitigation mechanisms will have been implemented to address (at least substantially) each barrier. These mechanisms will include over-investment in workflow and collaboration technology for teams who are remote from each other but who need to provide a single customer experience. They will also include matrix reporting lines where at least one dimension of each person’s reporting line is to a customer / segment owner and could also include various ‘inclusion’ techniques to bring remote or even outsourced teams into the mainstream.

Your people will EXPERIENCE what customers experience

Every possible opportunity will be exploited to encourage or even force your people to get a FEEL for the customers’ experience of interacting with the organisation. Wherever possible this will be direct experience either in an interactive role or in an observational role. Employee (and partner employee) purchasing and ownership experiences will be as close to those of external customers as possible. They will buy through the same channels, get products delivered in the same way, use the same service facilities and even complain through the same teams and processes. Where this level of interaction is not possible techniques such as job swaps and back-to-the-floor schemes are used to get people at all levels into customer situations.

Even where direct access to customer experiences is not possible (or desirable) indirect approaches will be in place such as wide-scale listening into telephone calls, recorded / filmed interactions or even just listening to feedback from mystery shoppers. These schemes will be carefully monitored to prevent them from becoming either personal or overly negative – great performance and experiences need at least as much coverage as poor. The focus will be on getting every single customer-impacting person closer to real customers and their experiences than they would otherwise be.

MOST of the customer basics will have been fixed

The mantra of ‘fixing the basics first’ will have been sensibly applied by a customer centric organisation. They will have recognised that the final 10% of fixes in even the most basic service delivery functions take a huge amount of time and resource. So, even if an organisation has a relatively low overall customer satisfaction performance (however they measure it) they will often have a majority of customers for whom the experience is at least ‘OK’. Their investment in improving the customer experience will be balanced between fixing the residual basics and pushing the experience for the majority forwards from just ‘OK’.

This may necessitate a change in thinking and focus from the senior management team who will often have become reliant on a single, relatively simplistic, score to tell them what the customer experience is like. This is particularly the case where this score is very focussed on ‘great’ and ‘terrible’ such as NPS or various ‘top-box’ approaches. A customer centric organisation WILL be interested in moving the middle ground up as well as addressing the extremes.

You will recruit and select for CUSTOMER CULTURE

The organisation will have defined the nature of customer culture that it wants to have will recruit employees and select suppliers based on their match to this culture. The definition will go deeper than just saying that people need to be nice to customers. It will define, often with the use of examples, the types of behaviour that are ‘on culture’ and those that are not. There will be various dimensions to the culture definition. For instance does the organisation want to portray informal friendliness or polite formality; does it want to give customer the impression that they are all treated the same or be explicit about looking after the best customers; are employees expected to give the impression of being able to fix anything or ‘knowing a man who does’.

Once the nature of the required culture is clear the ways of finding employees and suppliers / partners who match it will have been addressed. These will include changes to selection criteria and possibly the introduction of tailored psychometric testing. They often also include role play and immersion interviewing where potential staff spend a day on the job before being offered a position.

Your people will OBSESS about keeping promises

Whatever the customer culture to which the organisation aspires the most common thread in the hundreds of sets of research results that we have read is the critical importance of doing what you say you are going to do. Some of the most customer centric organisations have formal KYP (Keep Your Promises) programmes, measures and incentives. Others simply feature it as the overwhelmingly most important attribute in their defined customer culture.

In many organisations customer expectations are exceeded simply by getting back to customers when you say you are going to. As organisations become more customer centric the expectations of customers increase and sticking to specific commitments becomes a hygiene factor. This does not signify the end to obsession with keeping promises, it simply moves it up one or two levels. This could be around keeping a whole set of promises on an on-going basis, for instance in delivering against a customer charter. Ultimately it evolves into the delivery of the organisations’ brand promise/s in everything they say and do.

Customer-directed content will be personalised

All content of a promotional or relationship-building nature will be delivered, or not delivered, to individual customers depending on data available about them. At the most basic level this will prevent most marketing content being presented to customers that are known to have current service issues. At the next level content will be withheld, or ideally varied, based on the known value of a customer’s business.

However, real customer centricity must deliver content to customers using channels, imagery, and messaging that is based on a wide set of data about them. This data could include known interests, attitudes, browsing history, sentiment for Consumers and budget periods, market trends, purchasing process for Businesses. Even the media selected for non-personal communication will be bought programmatically, based on aggregated data about groups of target customers.

The whole organisation will TREASURE loyalty and advocacy

Whether or not it rewards purchase loyalty with points or prizes and advocacy with referral schemes the organisation will recognise the real value of both loyalty and advocacy. This recognition will be at the analytical level in terms of being able to put a value to a customer remaining with the business rather than having to find a new one and to a referred customer rather than another cost-of-sale. It will also be at the emotional / motivational level in terms of the way customers feel and the way that employees feel.

The organisation will understand how different types of customer want to have their loyalty and advocacy recognised even if it is not financially rewarded. They will have mechanisms and training in place to deliver against this understanding. Customer-facing staff will have the information they need to recognise how long a customer has been with an organisation or how much they have bought from them, ideally compared to how much they have bought from other providers. They will be briefed to feed this recognition and appropriate ‘thanks’ into conversation. For really long tenure customers there will be more pro-active contact from a senior manager to just say “Thanks for staying with us”. This has a great direct impact and also a huge advocacy impact as the recipients tell friends and other customers.

0 Comments